Pages

- Accueil

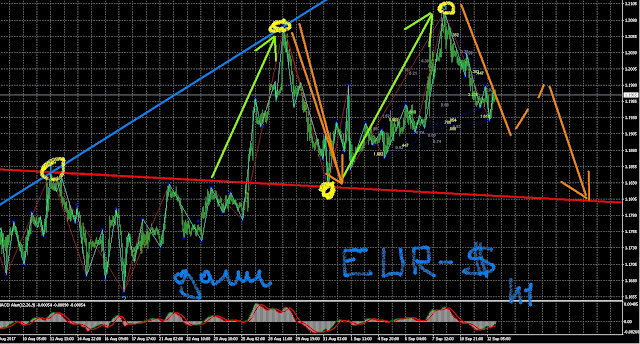

- OPZIONI FACILI GANN

- GANN OPTIONS SECRETS

- ELLIOT-WAVE

- GANN SECRETS

- FIBONACCI

- INVESTIRE CON LE TECNICHE DI GANN

- CANDLESTICK PATTERNS

- Dax Technical Analysis

- Elliottwave-Forecast

- GANN CHART

- DAX Outlook

- WD Gann’s Angles

- METAL REPORT

- GOLD REPORT

- Forex gann calculator

- FOREX SYSTEM

- IMPORTANT

- Pivot Point Definition

mercredi 29 novembre 2017

jeudi 9 novembre 2017

mardi 7 novembre 2017

vendredi 13 octobre 2017

What Happens When the Fed FINALLY Reduces Its $4.5 Trillion Balance Sheet?

By Editorial Staff

Tue, 10 Oct 2017 15:00:00 ET

So, there we have it. Deflation has started.

The Federal Reserve announced last month that they would start to reduce their $4.5 trillion balance sheet in October, thereby starting the process we call Quantitative Tightening (QT). As expected, they are aiming to do it gently and quietly, by not reinvesting bonds as they mature, starting with sums of around $6 billion of Treasuries and $4 billion in Mortgage-Backed Securities (MBS). The scale of non-reinvestment will gradually increase. Once in full swing, the Fed's balance sheet could reduce by up to $150 billion each quarter.

By Editorial Staff

Tue, 10 Oct 2017 15:00:00 ET

|

|

|||||

So, there we have it. Deflation has started.

The Federal Reserve announced last month that they would start to reduce their $4.5 trillion balance sheet in October, thereby starting the process we call Quantitative Tightening (QT). As expected, they are aiming to do it gently and quietly, by not reinvesting bonds as they mature, starting with sums of around $6 billion of Treasuries and $4 billion in Mortgage-Backed Securities (MBS). The scale of non-reinvestment will gradually increase. Once in full swing, the Fed's balance sheet could reduce by up to $150 billion each quarter.

jeudi 5 octobre 2017

mercredi 20 septembre 2017

FED

America's central bank announced it would begin to taper the size of its balance sheet next month while keeping the target for its main policy interest rate unchanged at between 1.0% and 1.25%.

vendredi 15 septembre 2017

Dear Trader,

Our Friends at Elliott Wave International are opening the doors to their entire lineup of trader-focused Pro Services -- but only for a week!

Now through Wednesday, Sept. 20, get free access to every forecast, every chart, every piece of expert analysis for 50+ markets -- stocks, forex, gold, oil and more.

Learn more and register for free.

BONUS: All registrants get instant access to 5 Markets Ready to Move Before Year-End. This timely report gets you up to speed on some of the most-compelling opportunities brewing right now and lessons that teach you to catch them.

Don't miss out! This event happens only once or twice a year. And, the timing couldn't be better. EWI's Pro Services are highlighting exciting market opportunities for subscribers right now. Open House is your chance to join them -- free for a week. Register now to get started.

Our Friends at Elliott Wave International are opening the doors to their entire lineup of trader-focused Pro Services -- but only for a week!

Now through Wednesday, Sept. 20, get free access to every forecast, every chart, every piece of expert analysis for 50+ markets -- stocks, forex, gold, oil and more.

Learn more and register for free.

BONUS: All registrants get instant access to 5 Markets Ready to Move Before Year-End. This timely report gets you up to speed on some of the most-compelling opportunities brewing right now and lessons that teach you to catch them.

Don't miss out! This event happens only once or twice a year. And, the timing couldn't be better. EWI's Pro Services are highlighting exciting market opportunities for subscribers right now. Open House is your chance to join them -- free for a week. Register now to get started.

Elliott Wave

Pro Services Open House

September 13–20

Our doors are open!

Get 24/7 access to intensive forecasts and new trading opportunities for 50+ global markets – stocks, forex, energy, metals, bonds.

Join in free

jeudi 14 septembre 2017

mercredi 13 septembre 2017

jeudi 17 août 2017

mercredi 16 août 2017

3 Videos + 8 Charts = Opportunities You Need to See.Join this free event hosted by Elliott Wave International and you'll get a clear picture of what's next in a variety of U.S. markets. After seeing this videos and charts you will be ready to jump on opportunities and sidestep risks in some major markets. This free report (a $29 value) will present a unique outlook and give you a new perspective on the markets you won't get anywhere else.Get your FREE report now -- for a limited time. |

Top 3 Technical Tools Part 1: Japanese Candlesticks

Elliott Wave International senior analyst shows you how to identify quality trade setups

By Elliott Wave International

"I always will be an

Elliottician, but other technical tools have merit and are indeed

worthwhile: they allow me to build a case, build a more confident reason

for making a forecast and for taking a trade; making a trading decision."

-Jeffrey Kennedy

I recently asked Trader's Classroom editor Jeffrey Kennedy

to name 3 of his favorite technical tools (besides the Wave Principle).

He told me that Japanese candlesticks, RSI, and MACD Indicators are

great methods to support Elliott wave trade setups.In this 3-part series, we will share examples of how to use these 3 tools to "build a case" in the markets you trade. These practical lessons allow you to preview how Jeffrey applies techniques with proven reliability to support his analysis.

We begin this first lesson with a basic candlestick-style price chart.

**********

You may be familiar with an Open-High-Low-Close (OHLC) chart:

comprised of vertical lines with small horizontal lines on each side.

The top of each vertical line is the high and the bottom is the low. The

small horizontal lines on either side represent the open and close for

that period.Here's an example of a Japanese candlestick chart:

Next, take a look at the chart below.

Two bearish candlestick reversal patterns that Jeffrey finds highly reliable are the Evening Star and the Bearish Engulfing patterns. This weekly continuation chart for the Canadian dollar combines a 20-period moving average to show that the trend is down -- allowing you to focus on bearish reversal candlestick patterns to spot trading opportunities.

**********

Japanese candlesticks begin our spotlight on 3 of Kennedy's top

ancillary tools for trading with the Wave Principle. Over the next two

weeks, we'll share parts two and three -- how Kennedy uses RSI and MACD

Indicators to support his Elliott wave interpretation.

3 Lessons: Learn to Spot Trade Setups on Your ChartsIn these three free video lessons, Jeffrey Kennedy shows you how to look for trading opportunities in your charts. Kennedy, instructor for EWI's popular Trader's Classroom service, explains how the 5 core Elliott wave patterns combined with technical methods such as momentum and Japanese candlesticks can help you create a compelling forecast.Get free, instant access |

mercredi 2 août 2017

vendredi 28 juillet 2017

Sugar Investors: "Desperately Seeking..." Clarity and Objectivity

Congratulations, Elliott wave analysis is your ideal match

By Elliott Wave International

Over the last two years, sugar futures have crashed and spiked and crashed again -- much like a diabetic without insulin.After plummeting to an 8-year low in September 2015, sugar prices then doubled in a stunning rally to a 4-year high in September 2016, only to turn back down in a 40% sell-off to19-month lows in late June 2017, where they linger to this day.

For nimble investors and traders, these kinds of erratic price swings are what opportunities are made of -- so long as they catch those moves before they occur and not after. It just so happens, we know someone who did just that.

Here, we turn the floor over to our chief commodities analyst Jeffrey Kennedy and his archived analysis of sugar since 2015.

The time: Mid-2015. Sugar prices are about as sweet as curdled milk, circling the drain of an 8-year low as the market is mired in a relentless bear market. Wrote an August 4, 2015 Wall Street Journal:

"The futures sugar market in New York behaves like an endless rerun of a horror movie."

But, according to Jeffrey Kenney, this "horror movie" was about to enjoy a happy turn of events. In his July 2015 Monthly Commodity Junctures, Jeffrey outlined a very bullish scenario for sugar, including these details:

"I've noticed over the years that significant turning points tend to occur in years ending 0 and 5... as we move into 2015, I'm actually anticipating a significant low. I'm looking for prices to bottom this year.

"I believe we're in the very late stages

of the initial move down. Ideally, say as move into the fourth quarter

of 2015, the [decline] will terminate ant that will give way to an

advance where I expect sugar prices to actually double.

"Once we do finish this move down, I will be looking for a sizable move, something that will easily push prices back up to 18, 20, even as high as 22."

What happened next?

Sugar prices bottomed in late September 2015, the "fourth quarter" time window that Jeffrey had identified.

By September 2016, sugar prices exploded upward in a 90%-plus rally to Jeffrey's 22 cents/pound price target.

By then, Jeffrey's analysis warned that the time for another dramatic turn had arrived -- this time, lower. Here, the September 29, 2016 Daily Commodity Junctures laid out the likely course ahead:

"Basis the March contract, the preferred

wave interpretation favors Sugar rising in five waves from 20.10 into

the 24.87 neighborhood. Doing so is scheduled to complete

a larger degree five wave advance from 13.48 basis March... as well as

an even larger wave degree three wave corrective rally sequence from

10.13 basis front month continuation.

"This projected market top should then set the stage for igniting subsequent selling pressure in five waves at weekly chart level."

Again sugar prices closely followed its Elliott wave script, rallying a bit further before losing its grip on the upside -- and falling 20%-plus before stalling in spring of 2017.

At the time, Jeffrey refocused his attention on sugar, featuring the market in his March 2017 Monthly Commodity Junctures. There, Jeffrey explained how sugar prices had taken the first "step" in confirming a renewed downtrend; i.e. they had penetrated the lower boundary line of the corrective price channel. Jeffrey affirmed:

"Everything seems to be on track for lower prices.

"The attention is now focused to the

downside. The objective I offered to at least below 12.61. Nothing has

changed and that idea is still very much intact."

From there, sugar prices plummeted

another 20% to their lowest level in 19 months in late June. The next

chart captures the market's precipitous drop in full detail:

The fact is, commodities are some of the most volatile markets in the world. And, fact is, Elliott wave analysis doesn't always deliver wave counts as strong and clear as the one's Jeffrey has identified in sugar over the last two years.

But you can always count on Elliott wave to deliver 100% objective insight into a market's near-, and long-term potential.

Oil, gold, ETFs & more: FREE pro-grade forecastsAre you paying attention to commodities? You should be.Major moves in oil, gold and other commodities have offered up huge opportunities for traders in 2017. Now through July 28, get free, professional-grade forecasts for gold, oil, ETFs and more inside the new Commodity Hotlist. |

jeudi 27 juillet 2017

Inscription à :

Articles (Atom)